Deliver secure, personalized, and 24/7 customer service experiences. Mobiloitte’s AI-driven banking solutions streamline operations, enhance customer loyalty, and ensure compliance effortlessly.

In today’s rapidly evolving landscape, banks, fintech platforms, insurance firms, and NBFCs consistently grapple with the multifaceted challenges of addressing ever-increasing customer expectations, navigating stringent regulatory requirements, and managing escalating operational costs. Consequently, Mobiloitte strategically empowers financial institutions by seamlessly leveraging cutting-edge AI-driven customer interactions, efficiently streamlining backend processes, and robustly implementing secure blockchain solutions, thereby enabling organizations to scale intelligently, securely, and compliantly.

In the realm of security, our Fraud Detection Systems play a pivotal role, safeguarding against fraudulent activities and instilling trust in all financial transactions. We leverage AI and Machine Learning for Financial Analysis, empowering clients with deep insights and predictive analytics for informed decision-making and risk assessment.

Mobiloitte’s advanced AI-driven Customer Care Bots seamlessly empower banks and financial service providers to instantly offer secure, compliant, and efficient service interactions. Key Use Cases and Pain Points Addressed:

Policy renewals and insurance claim updates – Improve client retention through seamless service interactions.

Employee-focused AI solutions seamlessly enhance internal workflows, consistently ensure compliance, and significantly boost efficiency, thereby effectively empowering banking employees.

Key Pain Points Mitigated:

Audit trails and activity logs for compliance tracking – Ensure transparency and regulatory adherence.

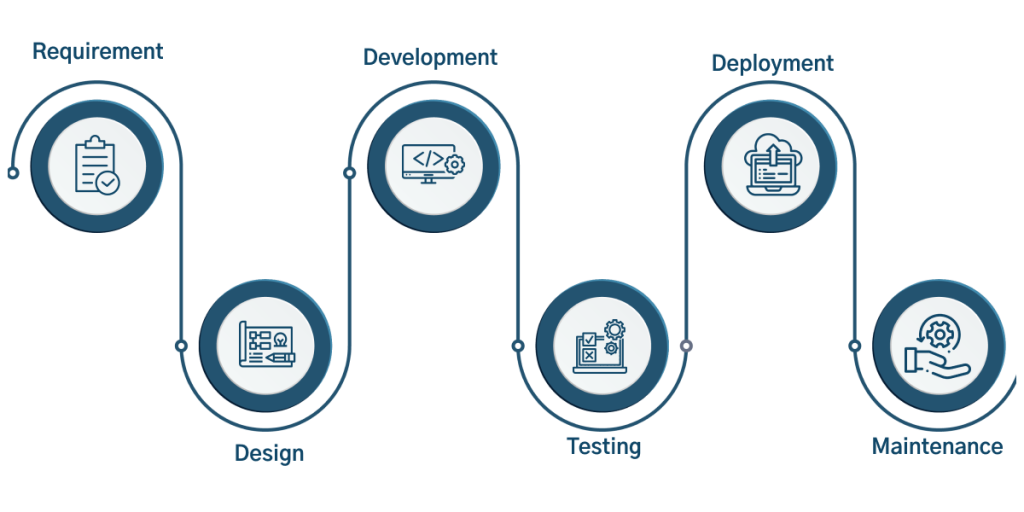

Mobiloitte expertly specializes in developing tailored banking apps and web portals, which are thoughtfully designed to significantly enhance customer convenience while simultaneously boosting employee efficiency.

Pain Points Addressed:

Blockchain technology, developed by Mobiloitte, not only provides enhanced security but also ensures transparency and efficiency for financial transactions.

Practical Benefits & Pain Points Addressed:

Mobiloitte’s advanced Data Analytics empower banks and financial institutions, thereby enabling them to leverage data-driven insights for strategic decision-making.

Major Pain Points Addressed:

In the sophisticated realm of the Internet of Things, devices like sensors and cameras intricately connect, relaying real-time data to cloud systems for advanced analysis. In banking and finance, IoT is crucial for streamlining data collection, digitally automating vital processes, and enhancing operational efficiency. Integration in BFSI firms refines services, fortifies transaction security, and fosters innovative customer experiences through seamless connectivity and data-driven insights.

Mobiloitte applies robust Answer Engine Optimization (AEO) strategies to ensure that client content ranks prominently in AI-driven searches, thereby enabling precise answers to consumer queries across platforms.

Benefits of Combining AEO with SEO:

Absolutely. Mobiloitte’s AI bots are developed on secure frameworks, fully compliant with PCI-DSS, SOC 2, and GDPR, ensuring encrypted, authenticated interactions.

Yes. Our bots qualify prospects, recommend relevant financial products, and seamlessly integrate leads into your existing CRM or marketing systems for follow-up.

Our bots effortlessly integrate with CBS, CRM, insurance platforms, and payment gateways via APIs or secure middleware.

Mobiloitte’s bots are specifically trained for banking and financial industry intents, offer comprehensive automation (beyond simple FAQ handling), and possess compliance-ready architecture tailored explicitly for BFSI.

Yes, Mobiloitte provides multilingual and voice-enabled banking assistants, ensuring diverse and inclusive customer service.

Typically, our banking clients see operational costs significantly reduced, often reducing call center loads by over 50%, enabling savings on resources and infrastructure.

We’re here to help your business grow and succeed in today’s fast-paced digital world.

At Mobiloitte, we lead digital transformation with AI-first applications across Blockchain, Mobile, Web, IoT, Gaming, and the Metaverse. Our industry-focused solutions leverage the power of AI, Blockchain, Data, and Cloud to drive success and innovation. By combining advanced AI with secure Blockchain and advanced mobile and web development, we empower industries to thrive in today’s fast-evolving digital landscape.