Arbitrage Bot Development Services: Maximize Profits with Automated Trading Solutions

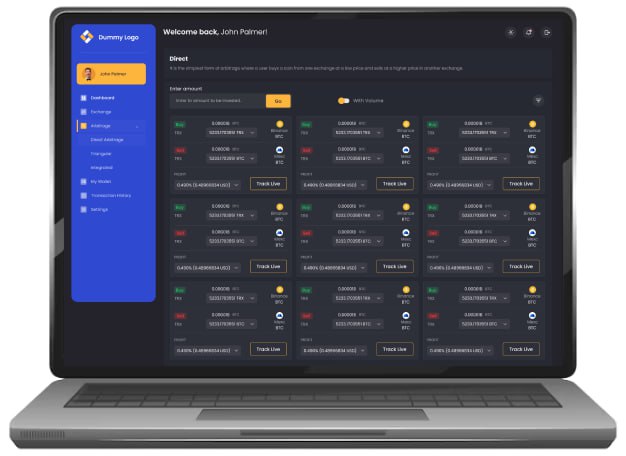

Arbitrage Bot Development Services Maximize the potential of your trading with Mobiloitte. Designed to exploit price discrepancies across multiple markets, this tool allows you to trade more efficiently and profitably. Moreover, with automated strategies and built-in risk management, the bot ensures optimized trading performance. Whether you’re a seasoned trader or just starting out, Mobiloitte’s Arbitrage Bot helps you enhance returns, reduce risks, and make smarter investment decisions.

Perform Market Data Analysis: Analyze market trends for better decision-making.Enable Non-stop Trading: Keep trading active 24/7.

Predict Market Risks: Anticipate potential market downturns.

Calculate Trading Indicators: Use reliable metrics to guide your trading decisions.

Ensure Efficient, Emotionless Trading: Execute trades without emotional bias.

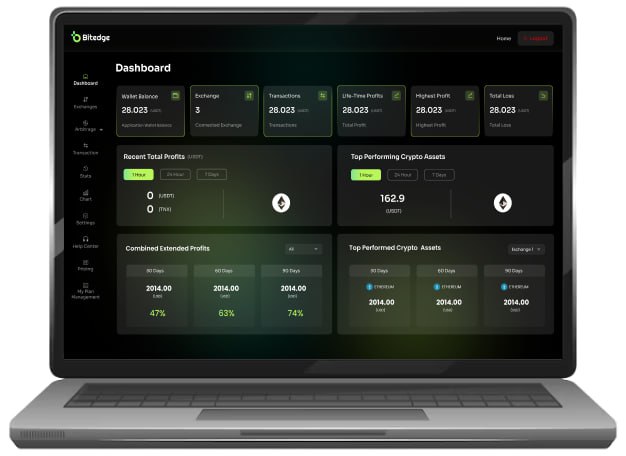

Visualize Graphical Results: Display data visually for easier analysis.

As a Blockchain Integration & Solutions Company, Mobiloitte’s Arbitrage Bot Development Services create AI-driven bots to exploit crypto price differences across exchanges, ensuring fast, secure trades. With 15+ years of experience, we deliver profitable solutions. Ready to trade smarter? Contact us!

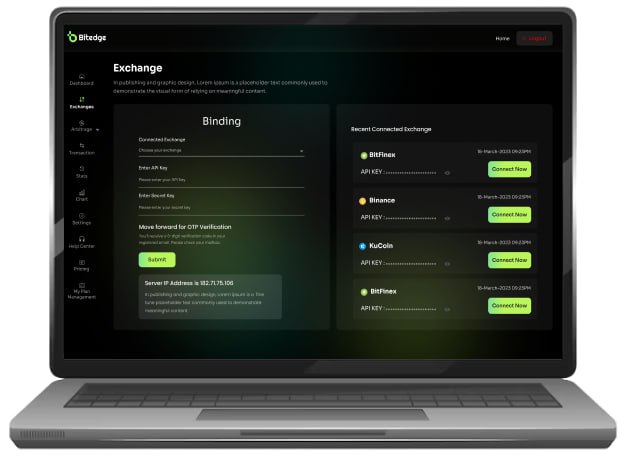

Our Arbitrage Bot Development Services use advanced algorithms, real-time data, and secure smart contract development company expertise to ensure reliable, high-speed trading. Our global team guarantees robust performance. Want a dependable bot? Reach out now!

Yes, our Blockchain development services integrate Arbitrage Bot Development Services with DeFi development company solutions and blockchain dApp development. We ensure seamless, secure trading platforms. Leverage our 15+ years of expertise—Get in touch!

With 15+ years as a smart contract development company, Mobiloitte excels in Arbitrage Bot Development Services, delivering 6,000+ projects globally. Our AI and blockchain expertise ensures profitable, secure bots. Trust us to innovate—Let’s connect!

Alongside Arbitrage Bot Development Services, we provide NFT marketplace development service, DAO Development, Launchpads Development, and blockchain dApp development. Our global expertise drives success. Explore our solutions—Contact us today!

Yes, our Mobile App Development Services deliver custom iOS and Android apps with AI Chat Bot Development and Mobile App and Web Solutions for trading, integrated with arbitrage bots. Enhance your platform—Talk to us!

We’re here to help your business grow and succeed in today’s fast-paced digital world.

At Mobiloitte, we lead digital transformation with AI-first applications across Blockchain, Mobile, Web, IoT, Gaming, and the Metaverse. Our industry-focused solutions leverage the power of AI, Blockchain, Data, and Cloud to drive success and innovation. By combining advanced AI with secure Blockchain and advanced mobile and web development, we empower industries to thrive in today’s fast-evolving digital landscape.