The banking industry is undergoing a major transformation driven by digital technologies and the rise of fintech. Traditional banks are facing increasing competition from new entrants that are offering more convenient, personalized, and affordable financial services. To survive and thrive in this new environment, banks need to embrace digital transformation and fintech. Click here

Digital transformation refers to the use of digital technologies to change the way a business operates. In the banking industry, this includes things like investing in new technology infrastructure, developing mobile and online banking platforms, and using data analytics to improve customer service.

Fintech refers to financial technology companies that use technology to provide financial services. These companies are often smaller and more nimble than traditional banks, and they are able to offer innovative products and services that are tailored to the needs of today’s consumers.

The following are some of the key trends that are driving the future of banking:

- The rise of mobile banking: Mobile banking is becoming increasingly popular as more and more people are using their smartphones and tablets to access financial services. In 2022, 64% of adults in the United States used mobile banking, and this number is expected to grow to 72% by 2025.

- The growth of open banking: Open banking is a new financial services paradigm that allows third-party financial services providers to access customer data from banks through secure APIs. This is opening up new opportunities for innovation, as fintech companies can now develop new products and services that are more personalized and relevant to consumers.

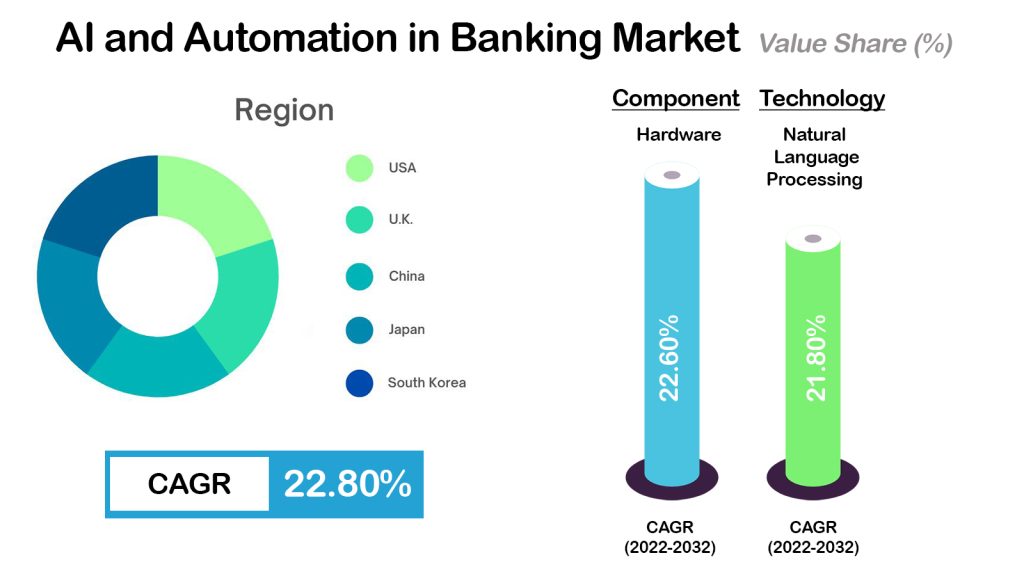

- The rise of artificial intelligence (AI): AI is being used by banks to improve a variety of operations, including fraud detection, customer service, and risk management. For example, AI can be used to analyze large amounts of data to identify fraudulent transactions or to provide personalized customer service recommendations.

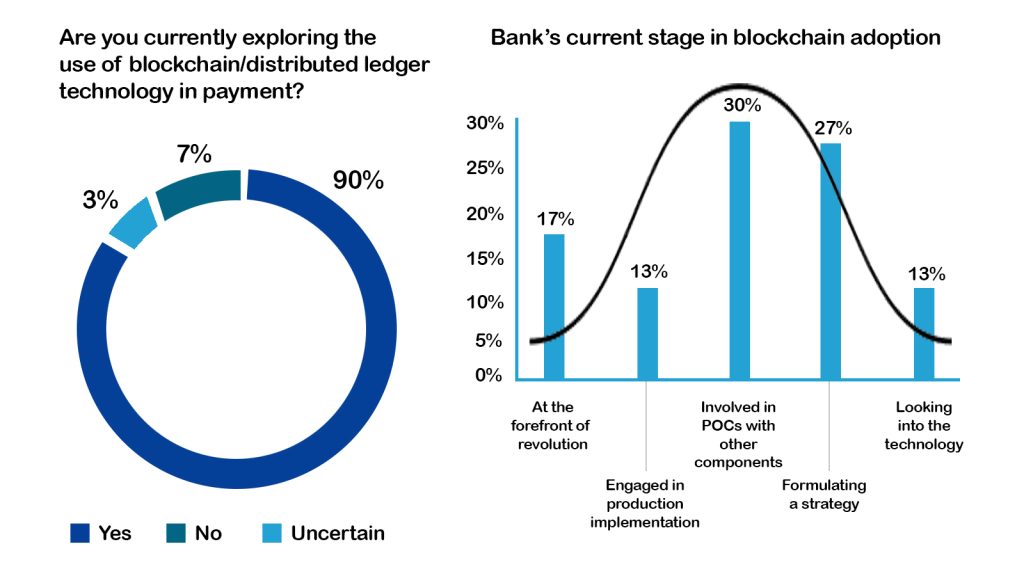

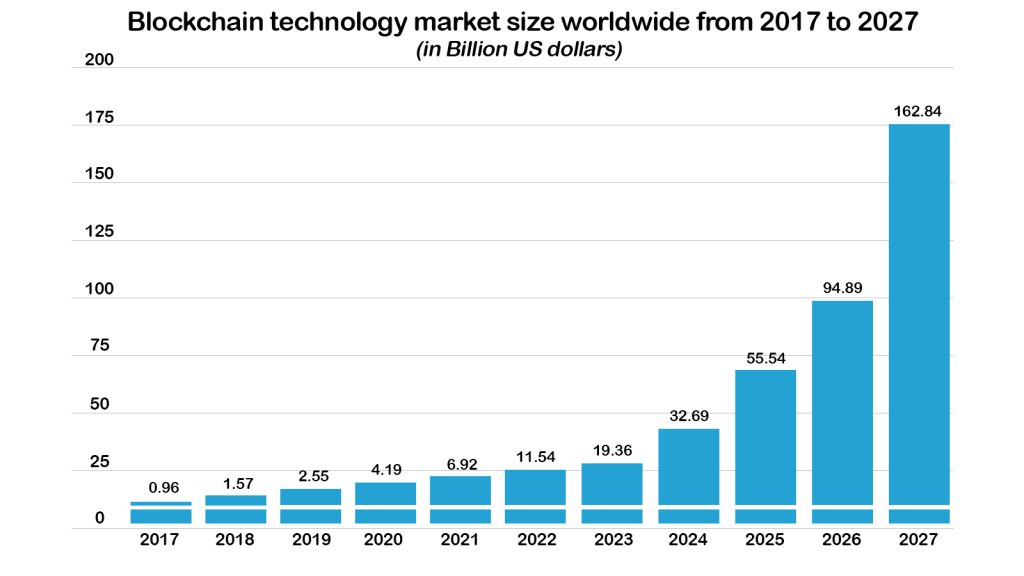

- The growth of blockchain technology: Blockchain is a distributed ledger technology that is used to record transactions securely and efficiently. This technology has the potential to revolutionize the banking industry, as it could be used to create new financial products and services, such as smart contracts and decentralized finance (DeFi).

These are just a few of the key trends that are driving the future of banking. As the banking industry continues to evolve, it is important for banks to embrace digital transformation and fintech in order to remain competitive and relevant.

Conclusion:

The banking industry is facing a number of challenges, but it also has a number of opportunities. By embracing digital transformation and fintech, banks can meet the needs of today’s consumers and position themselves for success in the future.

Thank you for shedding light on this important issue. Your blog is helping to raise awareness and drive change.