AMM Development Solutions

Unleashing DeFi’s Potential: Pioneering AMM Solutions for a Decentralized World

AMM (Automated Market Makers) Development

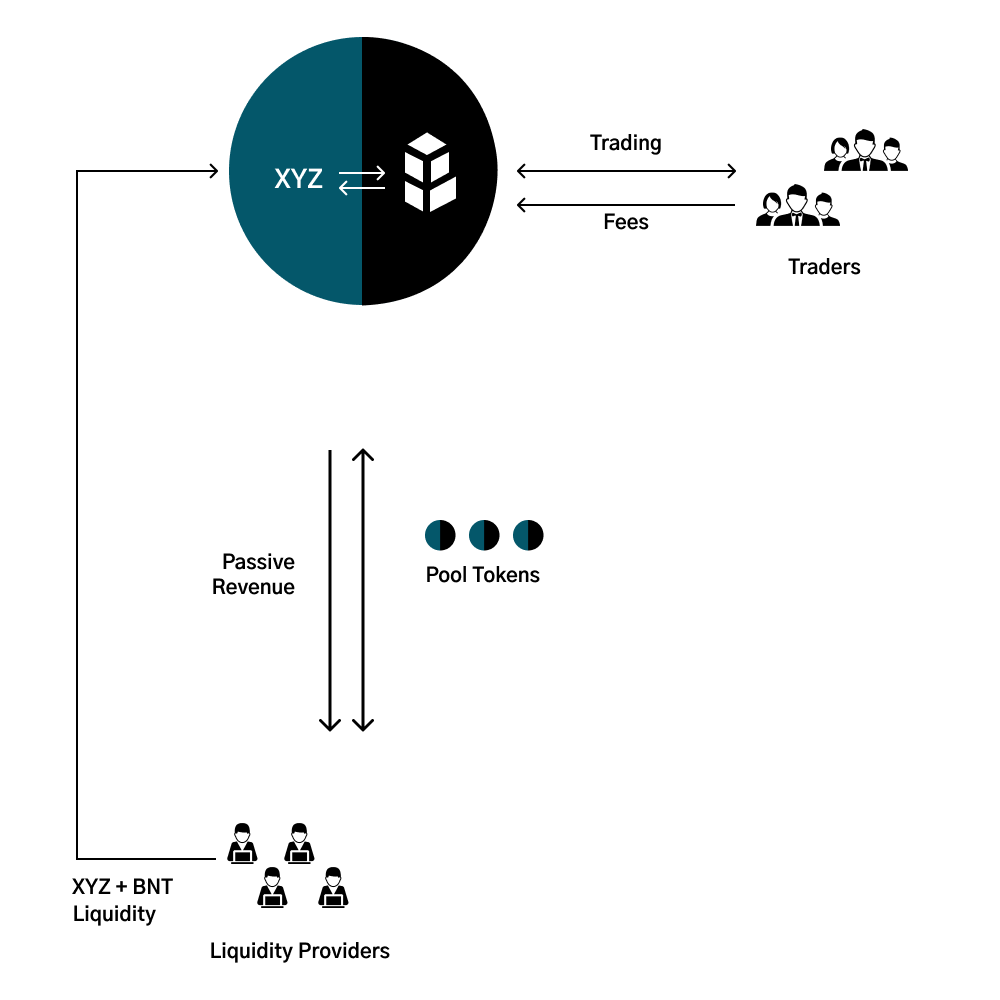

An Automated Market Maker is a smart contract-based protocol that enables decentralized token swaps and liquidity provision. By eliminating the need for traditional order books and relying on mathematical formulas, our AMM empowers users to trade tokens instantly and effortlessly while also providing liquidity to the market.

At Mobiloitte, we understand the complexities involved in designing and implementing AMMs that deliver optimal trading experiences. Our team of experts is dedicated to creating advanced solutions that enable you to build AMMs tailored to your specific requirements. Whether you’re an established cryptocurrency exchange or a startup venturing into the DeFi space, our Automated Market Maker Development services can help you unlock the full potential of decentralized trading.

Get in Touch

AMM (Automated Market Makers) Development Services

Smart Contract Development

Liquidity Pool Development

Yield Farming and Staking

Integration with Decentralized Exchanges

Features of AMM (Automated Market Makers)

Advantages of AMM (Automated Market Makers)

-

Increased Liquidity

AMMs generate liquidity in the market by allowing participants to trade directly with the liquidity pool, ensuring there are readily available assets for trading.

-

New Trading Models

AMMs introduce innovative trading models that differ from traditional order book systems, offering a fresh approach to trading and investment strategies.

-

Minimal Trading Delays

Transactions on AMMs are executed rapidly, with delays typically measured in milliseconds, providing traders with faster and more efficient trading experiences.

-

Mitigation of Market Manipulation

AMMs help reduce the possibility of front running, wash trading, and price manipulation, creating a fairer trading environment.

-

Reduced Price Slippage

Price slippage, which refers to the difference between the expected and executed trade price, is significantly reduced on AMMs, often measured in fractions of a cent.

-

Efficient Order Creation

AMMs allow for quick order creation and cost estimation, enabling traders to enter the market and execute trades without delays swiftly.

How AMM Solution Can Improve Your DEX?

Decentralized exchanges (DEXs) have revolutionized the way users trade cryptocurrencies and digital assets. At Mobiloitte, we offer automated market maker (AMM) solutions that can significantly enhance the performance and user experience of your DEX platform. Here’s how our AMM solution can improve your DEX:

Our AMM solution attracts liquidity providers and minimizes slippage, ensuring sufficient funds for trading on your DEX.

Enable instant and fair token swaps with our AMM solution, eliminating complexities and delays associated with traditional trading mechanisms.

Reduce transaction costs and intermediary fees, making your DEX more accessible and attractive to traders.

Automated market makers maintain token prices in line with the market, preventing large deviations and fostering a stable trading environment.

Integrate our AMM to empower token projects with liquidity pools, facilitating efficient trading and price discovery.

Seamlessly integrate our AMM with other DeFi services, expanding the functionality and utility of your DEX.

Our AMM solution is highly customizable and scalable, accommodating your specific requirements and future growth.

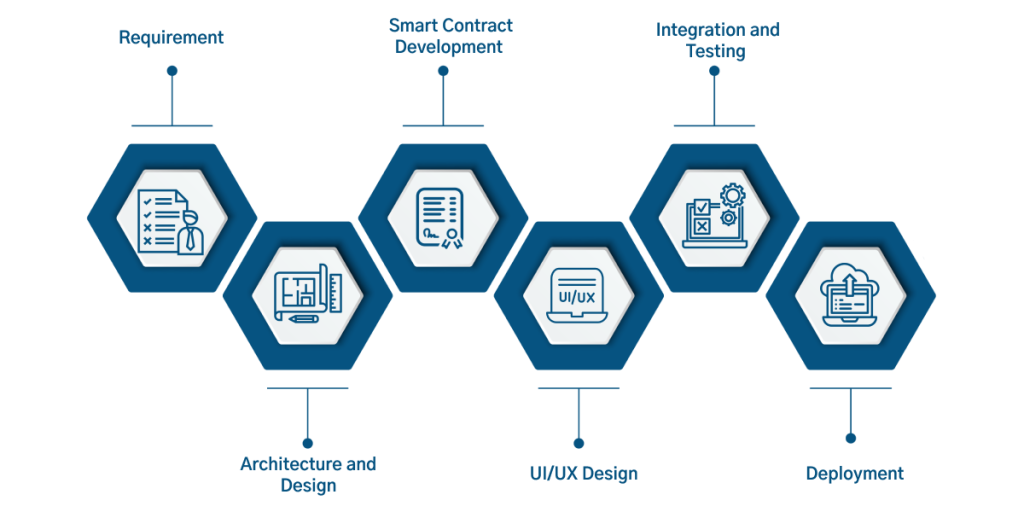

Development Process of the Automated Market Maker

Why Choose Mobiloitte for Automated Market Maker Solution?

Create efficient liquidity pools: Our expertise lies in designing AMMs that enable users to provide liquidity to various trading pairs seamlessly. We develop smart contract protocols that ensure fair and efficient price discovery, liquidity provisioning, and automated market depth adjustments, resulting in improved trading experiences and reduced slippage.

Customize algorithmic models: We recognize that different projects have unique requirements when it comes to pricing mechanisms and risk management. Our team works closely with you to develop algorithmic models that align with your project’s objectives, enabling you to create customized AMMs that cater to specific asset classes and trading strategies.

Ensure security and scalability: Security is of paramount importance in the world of decentralized finance. Our AMM development solutions prioritize robust security protocols and rigorous testing to safeguard user funds and prevent vulnerabilities. Additionally, we focus on creating scalable architectures that can handle high transaction volumes without compromising performance or user experience.

Integrate with blockchain ecosystems: Our AMM development services extend beyond the core algorithmic components. We help you seamlessly integrate your AMM with popular blockchain networks, ensuring compatibility and interoperability with other DeFi protocols, wallets, and decentralized applications (dApps).